How does invoice financing work?

If you’re doing research on invoice financing, you’re likely facing issues like these:

- You’re doing work upfront, and getting paid on credit 30, 60 or even 90 days later.

- You’ve got bills, HMRC and payroll to pay, but not enough cash flow to cover them.

- You’re needing some extra cash for a large purchase or an acquisition.

In this article, we’ll be diving into how invoice financing (also called receivable financing) works, how to get started and how to reduce the risk of clients not paying.

Note: are you looking for invoice financing support? With Satago, you just need to connect your accounting tool and you’ll get a quote within 24 hours. Learn more about our invoice financing product.

How does invoice financing work?

When you issue an invoice that has payment terms, rather than pre-payment or cash on delivery, those funds are then held by your customer for a preset number of days (30 days is most common, but others include 14 days, 60 days and 90 days).

This means that you have already spent money to provide the goods or services, but won’t get anything back until the term is completed (and if your client pays on time).

Invoice finance solves this problem by giving you cash advances based on the outstanding unpaid invoices in your debtor book. You can choose which eligible invoices you would like to fund and how long you would like to fund them for, and once approved the funds are then paid into your nominated bank account.

When the customer is ready to pay for the outstanding invoice, the amount is paid into a special “trust account” that is set up by the invoice finance provider. They will then transfer the remaining balance of the invoice, minus any fees back to your bank account.

What are the different types of invoice finance?

The four main types of invoice finance, these are factoring, discounting and single invoice finance (sometimes known as selective invoice finance or spot factoring) and full invoice finance (also known as whole or full book invoice finance).

Invoice factoring is where a lender effectively buys an invoice from your business. Once the invoice has been factored, it is up to the lender to collect payment from your customers. Customers will be made aware when you use an invoice factoring company, because they will have direct communication with your lender.

Invoice discounting is similar to factoring, but it’s up to you as a business to chase your customers for payment. If you don’t want your customers to know that you are using invoice finance, invoice discounting could be the best option for you.

With traditional invoice factoring and discounting, a lender will require you to finance your full sales ledger for a set amount of time. With single (also called selective) invoice finance, you can select which invoices you want to finance on a case-by-case basis with no long-term commitment.

Selective invoice financing vs full invoice financing

It’s worth diving into the differences between selective and full if you’re not sure which one is best for you.Very few invoice finance companies do both selective and full invoice financing, so you want to make sure which one you prefer before getting started.

Selective invoice financing

With selective invoice financing, you only get invoice financing on the invoices that you decide to. It usually follows a Pay As You Go model, where you pay for the select invoices that you’re getting financing on. You’re not tied into a contract, and have the flexibility to dip in and out of invoice financing as you wish.

This is what selective invoice financing looks like on the Satago dashboard. As you can see, it follows a similar approach to online shopping.

Selective invoice financing is great for those who don’t want to commit to something long term, or know that their cash flow problem is short term. If it’s your first time getting into invoice financing, selective is a low risk way to trial it before going for full invoice financing.

Get started now with selective invoice financing via Satago.

Full invoice financing

With full invoice financing, you get financing on every single invoice. Pricing may vary from invoice financing solution to solution, and it can often be hard to compare solutions on the invoice amount.

Usually, invoice financing solutions charge an arrangement fee, monthly fee, interest fee. But they’ll also charge disbursement costs, which are unexpected hidden fees.

Full invoice financing is usually best for those who have experience with invoice financing and know they will use it a lot. It’s also usually more cost effective in the long term.

Get started now with full invoice financing via Satago.

Types of Invoice Finance

- Choose individual invoices to fund

- No contract

- Disclosed

- Pricing per invoice funded

- Invoices must be within payment terms

- Invoices individually verified

- Fund all eligible invoices

- Minimum 12 month contract

- Confidential

- Clear and simple pricing

- Fund up to 120 days past invoice date

- Sample verification

- Fast approval and drawndown

- Automated reconciliation

- Credit risk tools included

- Automated credit control tools included

How this agency uses invoice financing to buy additional equipment

A digital agency has more work than the current staff members can handle.

The agency owner has just won an important new contract and knows she needs to invest in extra staff and equipment to complete the job.

But with clients taking up to three months to pay their invoices, she doesn’t have the funds to cover the costs.

The owner decides to finance an invoice worth £10,000 using a single invoice finance facility. She receives an advance of 85% of the invoice value at an interest rate of 2% per month. She uses the £8,500 to buy equipment for a newly hired digital designer who will work on the new contract.

At the end of the month, her client pays her the £10,000 she is owed, she repays the lender £8,500 plus the £170 interest fee and keeps the remaining £1,330.

In this case, the agency owner was able to use single invoice finance to fund new business needs and scale her company.

What happens if the customer doesn’t pay?

There is always a slim chance that your customers will become insolvent and unable to pay their bills, leading to bad debt (debt that is written off).

If, despite credit checks, you have concerns about running into bad debt, you can choose to take out bad debt protection as part of your invoice finance facility.

With bad debt protection, you will get paid even if your customer becomes insolvent, limiting the risk to you.

How can you reduce the risk of customers paying late?

Before proceeding with invoice finance, it’s a good idea to run credit checks on your customers to ensure there is little risk of them paying you late (or not paying at all).

A lender will also run checks and approve your invoices based on their own criteria. Once a lender has approved an invoice for finance, they will advance you a percentage of the value of the invoice (usually between 70 – 85%). You will receive the money in the bank and can use it to cover cashflow gaps or fund a new project.

Lenders will charge interest on the amount advanced then, once your client pays their invoice, the lender will collect the money owed to them plus the interest fees and you will keep the remainder.

You may like: Late Payment Fee Calculator: How to Charge for Overdue Invoices

How to get started with invoice financing with Satago

To get started with Satago:

- You can sign up directly on our platform and register your interest in invoice finance. Our invoice finance team will get notified and they’ll then get in touch with you to discuss your needs and offer a quote.

- You can also give us a call at a time that suits you.

- Alternatively, you can choose to go via a finance broker that will offer multiple different options depending on your needs.

It’s important to note that at Satago, we also do things a little differently:

- No hidden fees: Our invoice financing cost structure is clear and transparent, which means you won’t be stung by hidden fees you weren’t expecting. Our invoice financing solution only charges an arrangement fee, a monthly service fee, and an interest fee – nothing else.

- Get started with selective invoice financing: We’re just one of two or three providers in the UK who offer both selective and full invoice financing, and we make it easy for you to switch from one to the other. You can easily trial invoice financing by starting out with the selective option and seeing how you get on – there’s no contract to tie you in.

- Invoice finance, credit control and risk insights in one: Invoice financing is a great tool, but it doesn’t solve the underlying problem: to get back in control of your cash flow. With our credit control and risk insights tool, you can learn more about your clients and reduce your debtor days.

- Easy to set up: We don’t make you jump through unnecessary hoops to get set up. If you use accounting software that’s compatible with Satago, like Xero, Sage or Quickbooks, the integration is seamless and you only need to do it once.

Eligibility for Satago invoice financing includes:

- Be in B2B trade.

- Get paid on credit.

- Be a UK limited company.

- Trade with other limited companies.

- Use accounting software that connects to the Satago platform.

Once you sign up and are on the platform, you’ll be able to see how easy it is to apply for selective invoice financing. Head to “Finance” on the left taskbar and then follow the instructions to get started with selective invoice financing.

For full invoice financing, you will need to be approved via our team.

What else can you do with Satago?

Get paid faster with a credit control system in place

At Satago, we do more than invoice financing: we also offer multiple tools that will help you take back control of your cash flow.

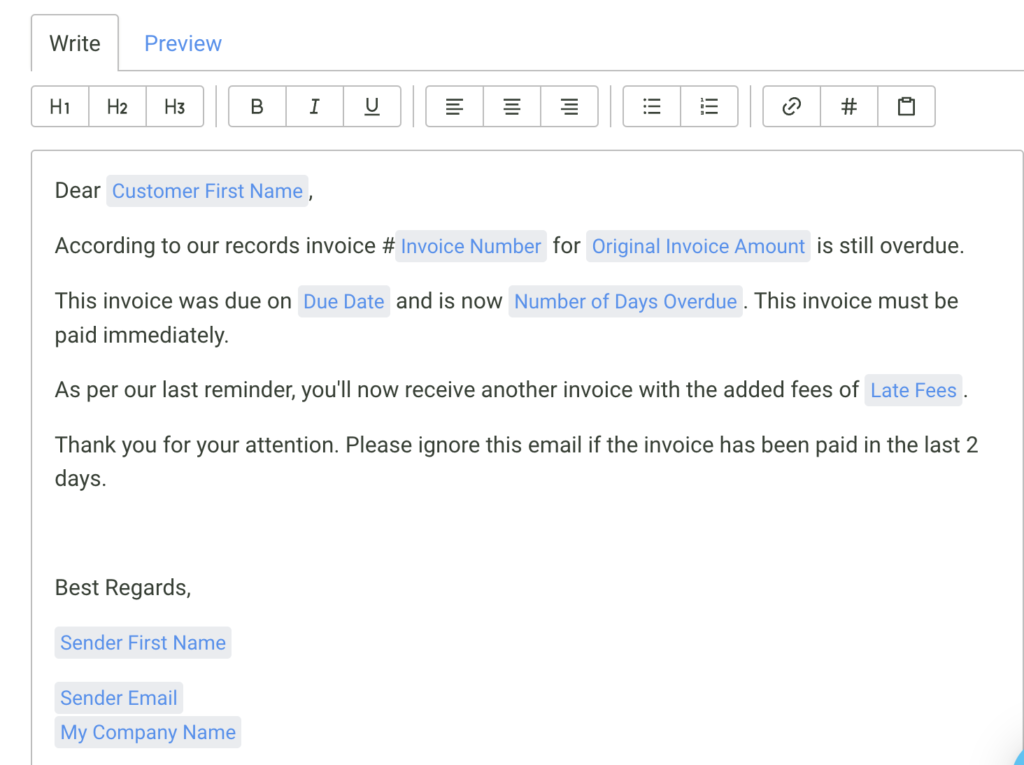

With Satago, you can set up automated reminder emails, monthly statements and thank you emails. For example, you can send:

- Invoice reminders before the due date.

- “Thank you for paying early” emails.

- Late payment invoice reminders that automatically include late payment fees.

- Grouped reminder emails.

All emails are fully customisable – both the email content and the sending schedule. This offers a lot more flexibility than you’d get with other solutions like Xero and Sage.

Learn more about new and existing clients using risk insights reports

The main issue with late payers is that you don’t know if they won’t pay on time until you start working with them. What if there was a way to foresee how well someone pays before working with them?

With Satago, you can run a credit search on a potential client, and get a full credit rating and report on how they pay.

You have access to:

- Credit search: view reports on the creditworthiness of clients or prospective clients. Can view unlimited numbers of snapshot summaries about prospective clients, but a limited number of complete credit reports each year (exact number depends on the plan they’re on – Standard = 3, Plus = 25, Premium = unlimited). Full credit report powered by Creditsafe and includes detailed info on directors and shareholders, financials, mortgages, CCJs, can be printed or saved as PDF.

- Analysis: This dashboard shows:

- Aged debtors: How overdue your invoices are in increments of 30 days. You can download a CSV or PDF report showing a breakdown of customers and how overdue they are, hyperlinked so you can easily navigate the system and send reminder emails or set yourself a reminder to call or follow up with them at a particular time.

- Risk segments: How many customers fit into which risk band.

- Risk concentration: This combines aged debtors and risk segments, so you could look at how many very high risk customers have invoices 90+ days overdue for example.

- Largest and oldest open invoices.

- Customer credit summary: How many customers fit into each risk band.

- Top industry segment concentrations: This shows which clients are in which sector.

- Highest risk active customers.

- Credit limit breaches: each client has a recommended credit limit based on the data held, and you see here if they’ve gone over their credit limit in overdue invoices. Can also amend this to a custom limit.

- Helps you make good decisions about who you work with, and how you work with them (credit terms, reminder emails etc)

Take back control of your cash flow

With Satago, you’ll find multiple tools on one platform. You won’t need to keep signing in and out of multiple tools to manage business accounts, cash flow and invoice reminders.

From one platform, you’ll be able to:

- Quickly learn how risky each client is and get free credit reports etc, to help you work out what credit terms to offer, and how to plan your approach to credit control.

- Set up automated invoice reminder emails, customised to your clients in language, schedule and frequency, as well as templating thank you emails and grouping your clients in a way that makes sense.

- Get a quick cash injection using invoice finance whenever you need it throughout the month.

Is invoice finance right for me?

Choosing to take on finance can feel like a big step for some small businesses. But, done correctly, it can become an important part of your cashflow management.

If you’re looking for a one-off cash injection to cover an unexpected bill or fund a new project, single invoice finance provides a fast and flexible solution and won’t necessarily require a personal guarantee or debenture.

If you’re unsure of what would be best for you, reaching out and talking to a finance broker can help clarify which type of financing would work best for you.

Want to get started with Satago? Sign up to our 14 day trial to get started.